File-Based Digital Assets

The Building Block of the Knox System - Representing All Assets in a Common Format

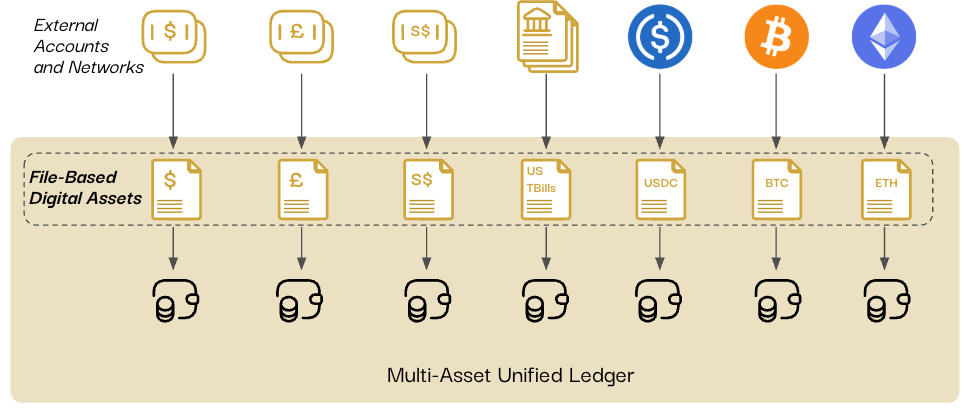

The building block of the Knox Network system is the File-Based Digital Asset (FBDAs), which is moved through the system and between stakeholders via the Multi-Asset Transaction Transaction Platform. FBDAs are not actually files but are instead just a conceptual shorthand to simplify their meaning and instead are a common data structure (a JSON Binary Large Object, or BLOB) stored in a traditional database.

FBDAs serve as a common building block on the platform, representing all forms of different assets - whether it be cash, deposits, crypto, securities, or something else. Knox represents these assets as FBDAs through a process known as Digital Twinning.

Represent any asset in a standard digital format so you can store, transact, audit, secure, and manage all asset types in a unified manner.

Digital Twinning Assets into FBDAs and bringing them onto the Knox Platform

FBDA Structure

Diagram of File-Based Digital Asset (FBDA) "Digital Twinning" $5.00 USD

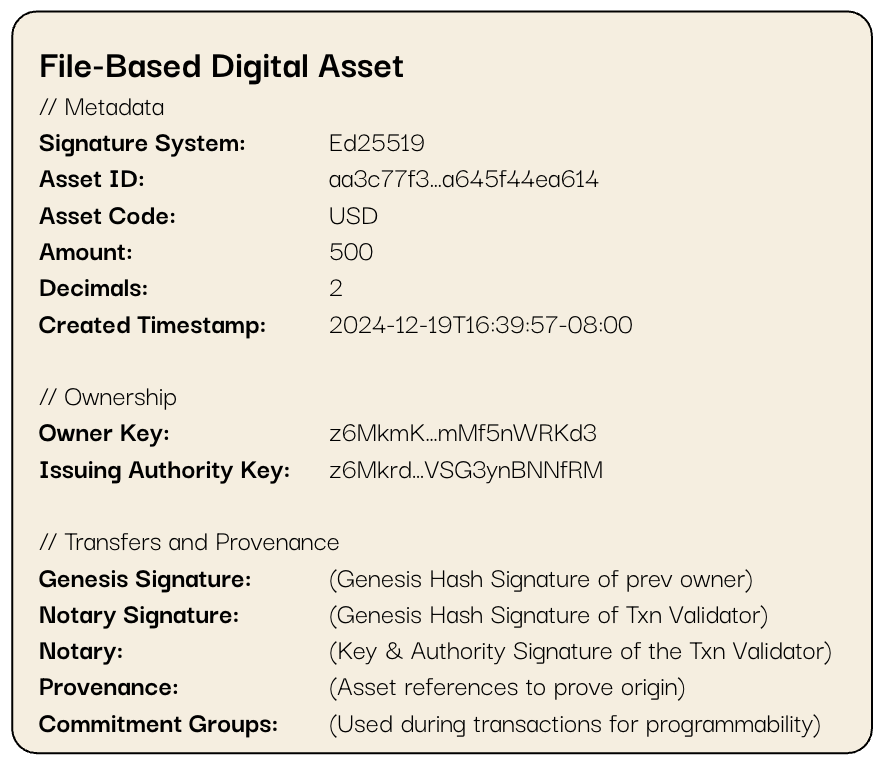

File-Based Digital Assets are designed to be flexible for different assets.

- The

Asset IDserves as a method of uniquely identifying the FBDA in the system - The

Signature Systemfield is for identifying which cryptographic signature system is in use Asset ID,Amount, andDecimalsare for specifying the value and type of asset being twinned (e.g. $100 USD)- The

Created Timestampis to signify when the FBDA was first created

For ownership, the Verifier of Owner field and the Verifier of Authority fields are used to determine the current holder and the original issuer of the asset, respectively.

Transfers and Provenance

Each FBDA contains the Genesis Signature to prove the original authenticity of the asset. Subsequent transfers require the use of the Notary and Provenance fields (simplified in the above graphic) to prove the transfer of assets is legitimate.

Knox utilizes a two-phase commit process to only fully transfer assets after receiving confirmation specified in Contract-Based Transactions.

This two-phase process helps to secure FBDAs and ensure atomic settlement without the need for a full clawback.

This discussion focuses on the signing and transferring of FBDAs directly on the Knox system, but FBDAs can be transferred under a variety of schemas. Relevant messaging standards (e.g, ISO 20022) can incorporate FBDA information directly as part of a message payload, for example.

Changemaking and UTXO

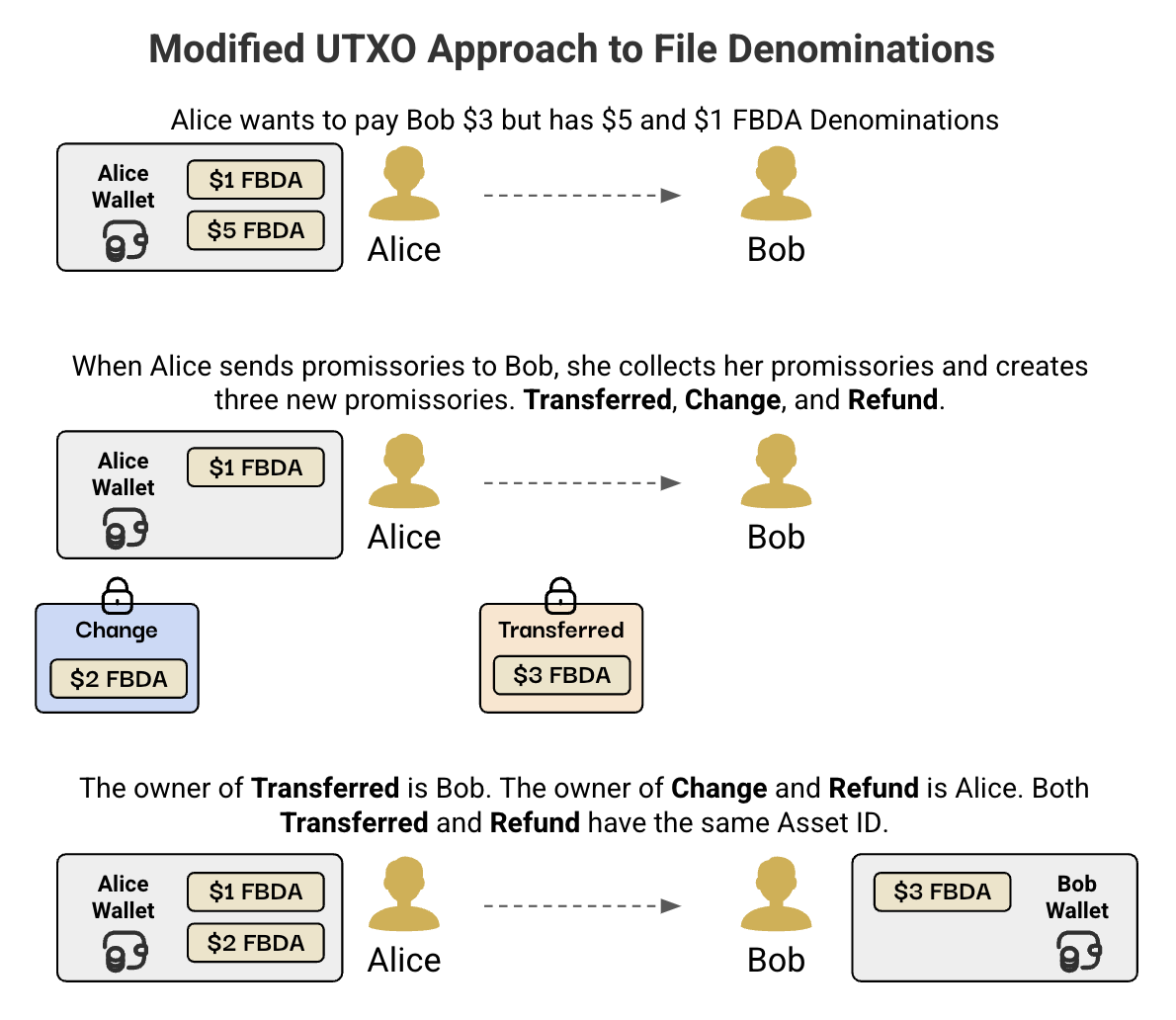

FBDAs are given a fixed value at the time of issuance (say $5.00 USD), but may be asked to fulfill situations where this is not possible (e.g., trying to pay $4). Knox utilizes a modified UTXO approach to file denominations, allowing for changing files into different denominations as required.

When Alice sends promissories to Bob, she collects her promissories and creates three new promissories. transferred, change, and refund.

- The owner of

transferredis Bob - The owner of

changeis Alice - The owner of

refundis Alice

When the FBDAs are locked in, the Transaction Validator authorizes the unspent immediately and returns it.

This allows Alice to use this in a new transaction while the previous transaction is still in progress.

As for transferred and refund FBDAs, depending on how the logic in the contract plays out, the Transaction Validator will authorize transferred or refund, but not both.

The Transaction Validator signs and verifies FBDAs during a transaction to confirm this.

A sample example is below:

Sample UTXO Transaction

Conclusion

File-Based Digital Assets are able to serve as the common asset representation upon which the Knox system is built. FBDAs may be various different asset types across various systems, from USD, to other currencies, securities, crypto and stablecoins, all of them are represented in our ledger in a standard digital format so you can store, transact, audit, and manage all asset types in a unified manner. They are designed to be lightweight, flexible, and able to serve a variety of different use cases while still remaining simple to understand in their function as a "Digital Twin" or natively issued asset.

FBDAs can safely and securely be transferred through Contract-Based Transactions via the help of the Transaction Validator Service.

Updated 4 months ago